An Unofficial Response to "An Empirical Analysis of Linkability in the Monero Blockchain"

April 19, 2017

Preface

This release attempts to contain the opinions of the Monero community. It is possible that not every viewpoint is expressed, but this paper includes the best response to the author's ability that encapsulates all these opinions. The author opens all discussion to how certain viewpoints are represented, and the purpose of this response is solely for easier documentation by interested parties. He has done the best to include sources wherever possible, and to be as accurate as possible. For any concerns with this publication, please express them to the author's Reddit account or on the Monero subreddit. This version has been updated for clarity, though the core content has remained unchanged.

The Monero contributors and community at large always appreciate any research done on Monero's technology. They heavily encourage constructive criticism of all cryptocurrencies.

Notable Findings

The Monero contributors appreciate the effort that has gone into this mentioned publication and research methods. It helps quantify several realizations that had already been known to the Monero community at large for a long time (ref: MRL-0001 and MRL-0004), including the following:

-

0-mixin transactions (those that only include the real input and no others) are traceable on the blockchain. MRL-0001 (published September 2014) also points this out, and Monero reacted to the concern by prohibiting 0-mixin transactions from the network in April 2016. The current minimum mixin allowed on the network is 2, which was mandated in March 2016. In September 2017, the minimum will be increased to at least 4, though there is some discussion going on in the community to choose the exact value. For clarification of terms used, ringsize is a newly-adopted term to replace mixin with the intentions of removing comparisons to traditional mixing services. Ringsize = mixin + 1.

-

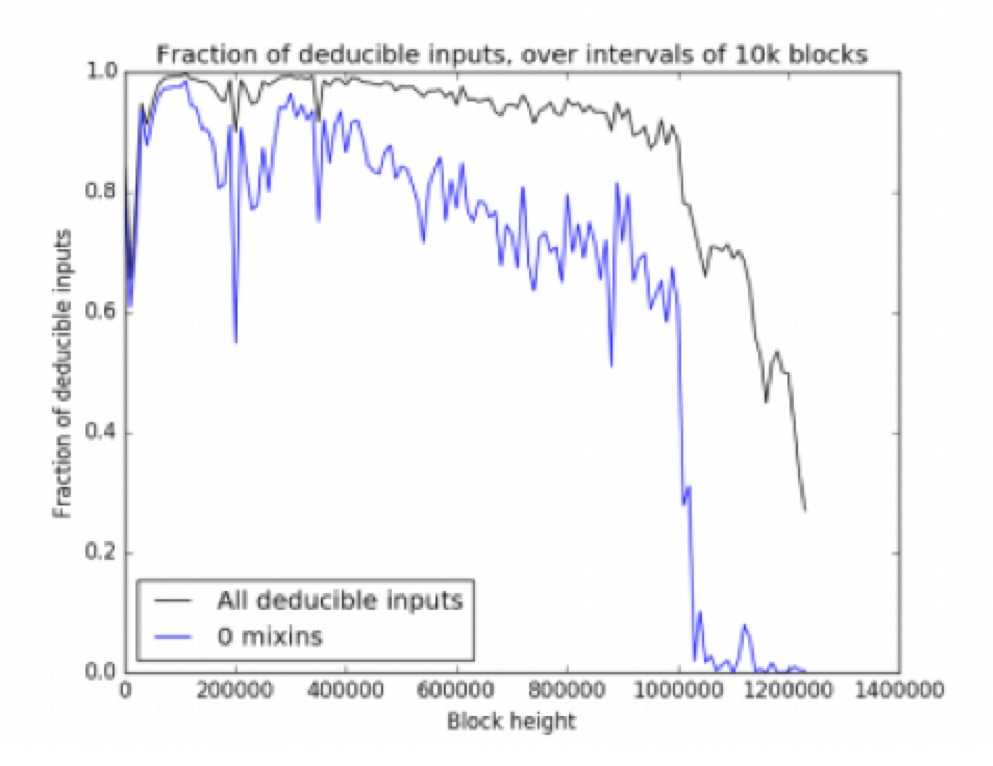

The prohibition of 0-mixin transactions has allowed the network to recover relatively quickly by making it harder to know which input is used. This paper helps quantify this recovery, from about 95% traceable to 20% traceable (see appendix).

-

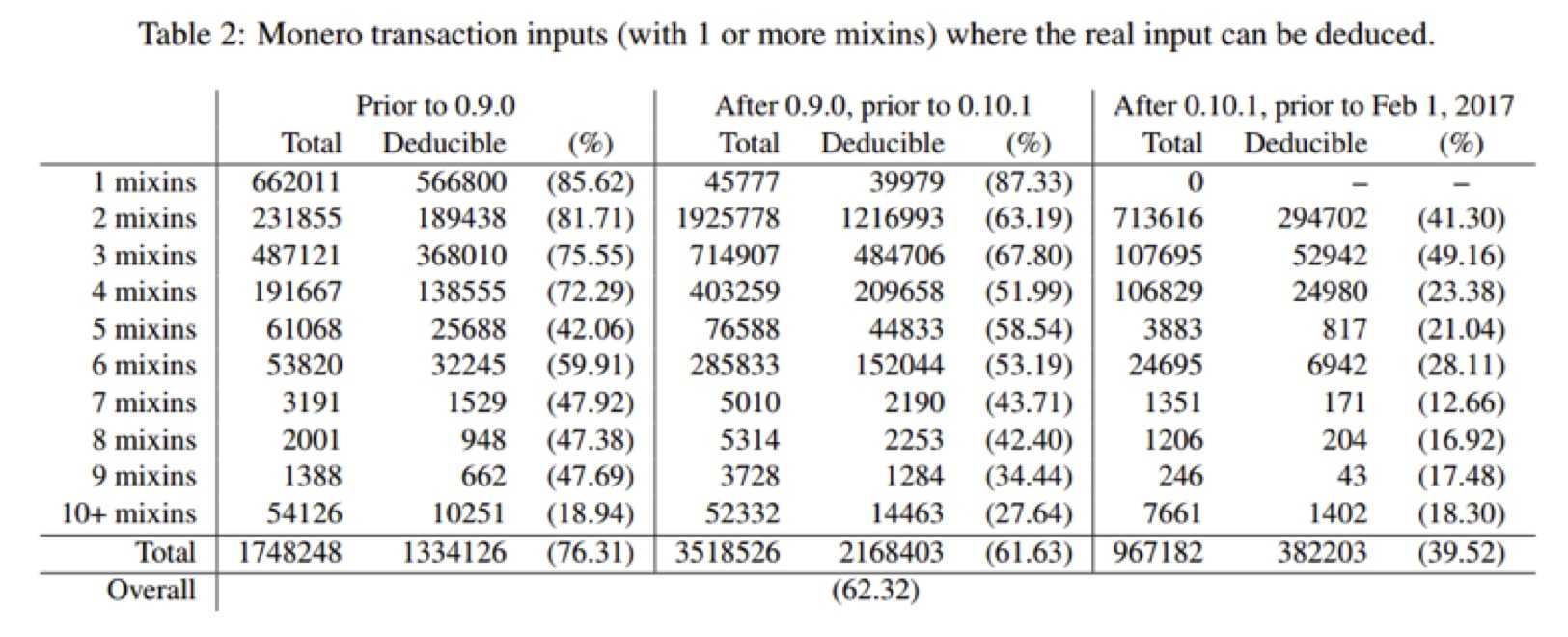

The proportion of transactions that have their inputs deducible has fallen substantially from 1 January 2016 to 1 Feb 2017 with 2 and 4 mixin transactions. Respectively, these fell from 82% and 72% to 41% and 23% (see appendix). Furthermore, this proportion is down to 0% with RingCT transactions, which are now over 99% of all new transactions on the network.

-

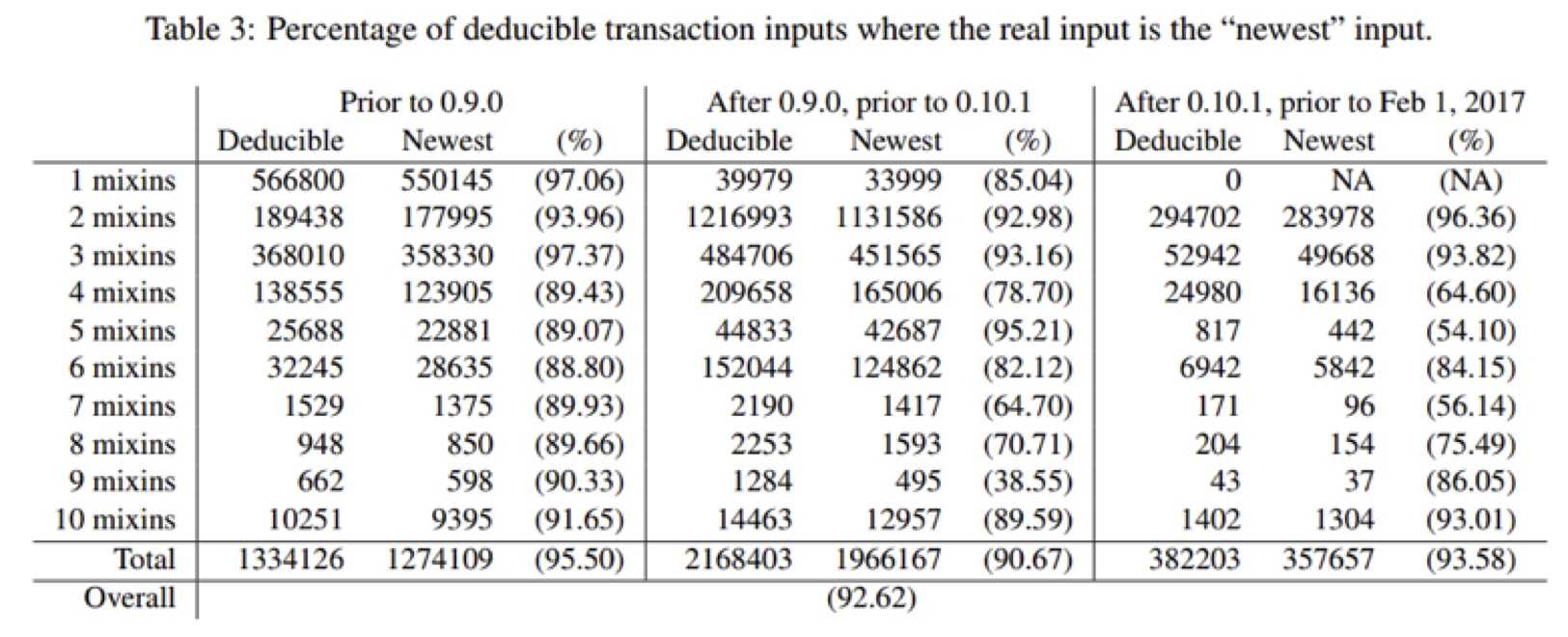

The phenomenon where the most recent input is the real one is a concern when using Monero. There is no way to prove that this input is indeed the correct one, and with recent transactions, the assertion is nearly impossible to prove and is accurate less than half of the time. As the report states, there is about a 40% chance that the most recent input in a default transaction is the real one. Ideally, this number should be closer to 20% (1 in 5). Note that this does not mean that there is a 40% chance that this transaction is traceable (see appendix). Increasing the transaction ringsize has only a marginal improvement.

Recommendations and Responses

The following are the recommendations listed in the paper and responses to them:

-

The mixing sampling distribution should be modified to closer match the real distribution. We agree with this recommendation. The discussion covering the possible ways to do this, along with all associated research, can be seen on GitHub . As the paper acknowledges, we made a temporary improvement to the selection algorithm to choose more recent inputs (instead of pure random selection) in December 2016. Further improvements are required, and they are planned to be ready before or at the September 2017 hardfork date. As the paper notes, this change is not consensus-critical. It can be done the day after completion without a hardfork.

-

The Monero community should engage in further data-backed analysis of privacy claims. We agree with this recommendation. Data-backed claims are an excellent way to improve the Monero privacy and security features. As stated in the paper, the threats discussed in the paper were discussed in the community previously. Unlike the paper claims, these discussions were not "informal"; instead, they were published in our MRL-0004 research paper in January 2015. Nevertheless, several of these attack vectors explained in the Decentralized Systems Lab paper are quantified for the first time.

-

Monero users should be warned that their prior transactions are likely vulnerable to linking analysis. We mostly disagree with this recommendation. The vulnerabilities of 0-mixin transactions were well-documented and continuously shared with the Monero community while they were still allowed. The first research paper shared in the Monero community (MRL-0001) was published in September 2014. Furthermore, most of Monero's community growth occurred after these 0-mixin transactions were prohibited across the network.

Concerns

The Monero community would like to list several concerns with this research paper. They are documented below:

-

We believe that a large proportion of 0-mixin transactions are pool payouts. These transactions should come to no one's surprise that they are traceable, since the pools themselves publish the payment amount to each transaction hash. Thus, we believe that the claims stemming from the traceability of transactions before 0-mixin transactions were banned to be misplaced. If, for example, 50% of non-pool payouts used a positive mixin and 0% of pool payouts did, then the traceability is less for the transactions that use these mixins and greater for pool payouts. We recommend that this is acknowledged in a later iteration of the paper. Ideally, the proportion of pool payouts can be found and compared to the proportion of non-pool payouts, with different traceability proportions for each. There are several reasons why these transactions neither reduce the anonymity of the transaction itself or other users. In regards to the former, coinbase transactions (ie: new rewards given to the pool) are 0-mixin, since having mixins is useless if the input is brand new and seen for the first time. Anyone who mines understands that the source of their money is clear, and so pools received little pressure to increase the ringsize for payout transactions. In regards to other transactions, the pool payouts occur within the day, reducing the negative impact spending these transactions has on other users who may have borrowed the input for their transaction. Thus, pool payouts should include additional mixins, but excluding them has relatively minimal harm. The larger threat is the opportunity cost, where the additional mixins could provide greater levels of privacy for other users. Furthermore, all transactions are still unlinkable by the MRL definition of the word (see "Other Information" point 4) (source).

-

We think further emphasis should have been placed in the paper to explain that the claims are only minimally applicable with the state of Monero transactions since March 2016, with the relevance decreasing over time. Though it is mentioned that their first analysis method has little if any current or future relevance, the claims still include these transactions. 0-mixin transactions were prohibited in March 2016, and most transaction volume for the year occurred during and after August. Nevertheless, many of these post-March transactions have inputs that can be deducible, but the traceability typically is not as severe as with 0-mixin transactions. The transactions that are most vulnerable are those in 2014 and 2015, as well as some time needed for the network to recover.

-

Under the "ethics" section, they state that the paper was published immediately before countermeasures could be deployed. While this is understandable from the given perspective that the blockchain history is not going away anytime soon (or ever), we wish that they had given us an advance copy of the finished draft so that we could have discussed our concerns with the report itself. We wish not to censor any of the research (instead, we encourage research!); however, we hope that future care can be taken before the release of misleading assertions.

-

Andrew Miller was named in the paper as a consultant to the Zerocoin Electric Coin Company and a board member of the ZCash Foundation. ZCash is a cryptocurrency with a focus on privacy that uses different technology than Monero. However, he downplayed his involvement in an interview about this paper. We feel author involvement in cryptocurrencies with similar interests should be fully disclosed, though he did refer people to the first page of the report. Nevertheless, we feel that Miller's disclosure of his contribution to a competing project was unsatisfactory, given the severity of the allegations in the paper.

Other Information

-

The timing of the publication. This paper was released approximately an hour before the hardfork. While it is impossible to know the reason for the specific timing without an admission, we speculate that this was timed to draw as much attention to the paper as possible. More people would have been tuning in to see how the hardfork was proceeding than typical community participation traffic. Andrew Miller has responded to this criticism in a Reddit comment, saying "the timing of our release with the imminent hard fork was totally unintentional and a coincidence. No one on the team noticed there was a hardfork planned, and we'd definitely have delayed till afterward if we had."

-

This paper was shared as "new research" about Monero. While the research is itself new and some of the analysis is the first time that some concerns have been quantified, these concerns themselves are not new. In sharing the paper, the authors often posted misleading claims that asserted these concerns were new.

-

The Monero Core Team was given an advance draft of the report on 15 March 2017. This report at the time looked only at transactions before January 2017. All further edits to the paper were published before consulting with the Core Team. Riccardo Spagni, known to many as fluffypony or fluffyponyza, responded commending the efforts and stated at the time that the 0-mixin analysis confirmed previous work on MRL-0004. During the email exchange, Spagni suggested that the research also be published in the Monero Research Lab research, an idea Andrew Miller seemed open to at the time. Furthermore, the real release date was later than the target given to the Core Team, and the Core Team was not given a new estimated date of release.

-

The paper refers to the traceability of transactions in the blockchain as "linkability". We encourage the authors to change the terminology to "traceability", since linkability typically refers to the ability to connect cryptocurrency wallet location to real-world locations. This will help clear up misconceptions held by many community members, since the Monero Research Lab refers to the connection of funds within the cryptocurrency as "traceability."

-

This paper has not yet been published, is not finalized, and is not yet peer reviewed. Thus, there will most certainly be changes to this research paper before publication. We suggest that all claims and research be taken as preliminary and not concrete, since not enough people have evaluated their methods of research yet.

Conclusion

We appreciate the effort that went into this research paper, but we suggest the following changes for later improvements:

-

A re-evaluation of recommendation #3.

-

A consideration among 0-mixin transactions for pool payouts.

-

A clearer explanation of claims made in the paper, with separations for the history of all transactions and those used since March 2016. It is disappointing to treat the blockchain data as static when the technology has evolved significantly since Monero's launch.

-

Future drafts to be shared with the Monero Core Team before release. Their contact information is [email protected].

-

Be more conservative sharing the results. We understand that the authors have an incentive to share the results with others and we also want them to be shared, but we ask that they refrain from using misleading claims to gather traffic (see appendix for example).

-

Consider cooperating with Riccardo Spagni to permanently include the research portion of this paper in our Monero Research Lab documents.

Appendix

Figure 5 from the report showing the fraction of deducible inputs. Notice the large drops following block height 1,000,000, when 0-mixin transactions were prohibited. Furthermore, these inputs likely do not include all those used in a single transaction. For instance, for a mixin 9 transaction, 5 may be deduced. This means that the inputs would be reported here as deducible, even if the transaction is not traceable.

Table 2 from the report showing the proportion of transactions with a positive mixin that can be deduced. We want to make clear that the findings of this chart and analysis method have absoutely zero relevance to RingCT transactions.

Table 3 from the report showing the proportion of deducible transactions where the real input is also the most recently used one in the transaction.

Examples of statements we find misleading

This is a tweet from a contributor to the paper.

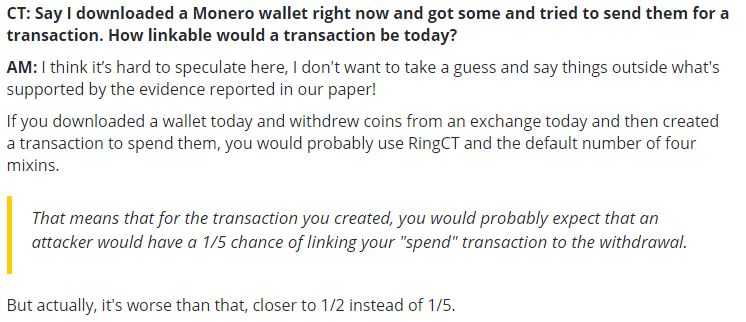

This image is from the CoinTelegraph interview. Based on the wording, you may think an attacker could determine with certainty which input is yours. However, the attacker can guess and be correct less than half of the time. Furthermore, even if the attacker guesses correctly, there is no way of proving this with certainty with data from the blockchain alone.

Andrew Miller asked us to include other statements from the researchers or ZCash Foundation members that we feel is misleading. This paper is not supposed to be a comprehensive list of such statements. It is only useful in providing a few examples.

This draft was shown to Andrew Miller before release on the website. Some of his considerations have been included in this response.

Post tags : Monero Core, Cryptography, Monero Research Lab, Community